Page 55 - RFU Annual Report 2018

P. 55

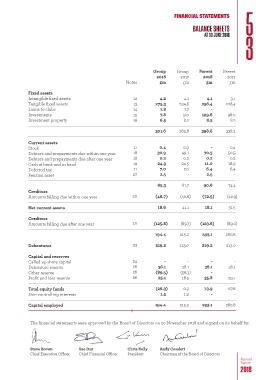

FINANCIAL STATEMENTS

BALANCE SHEETS 5

AT 30 JUNE 2018

3

Group Group Parent Parent

2018 2017 2018 2017

Notes £m £m £m £m

Fixed assets

Intangible fixed assets 12 4.2 4.1 4.1 3.7

Tangible fixed assets 13 275.3 234.8 258.4 228.4

Loans to clubs 14 7.8 7.7 - -

Investments 15 7.8 9.0 129.6 98.0

Investment property 16 6.5 8.2 6.5 8.2

301.6 263.8 398.6 338.3

Current assets

Stock 17 0.4 0.9 - 0.4

Debtors and prepayments due within one year 18 30.9 49.1 70.5 50.5

Debtors and prepayments due after one year 18 0.2 0.2 0.2 0.2

Cash at bank and in hand 19 24.3 24.5 11.0 16.9

Deferred tax 11 7.0 7.0 6.4 6.4

Pension asset 27 2.5 - 2.5 -

65.3 81.7 90.6 74.4

Creditors

Amounts falling due within one year 20 (46.7) (40.6) (72.5) (42.9)

Net current assets 18.6 41.1 18.1 31.5

Creditors

Amounts falling due after one year 20 (125.8) (89.7) (123.6) (89.0)

194.4 215.2 293.1 280.8

Debentures 23 219.2 213.0 219.2 213.0

Capital and reserves

Called up share capital 24 - - - -

Debenture reserve 26 38.1 38.1 38.1 38.1

Other reserve 26 (89.5) (56.3) - -

Profit and loss reserve 26 25.1 18.5 35.8 29.7

Total equity funds (26.3) 0.3 73.9 67.8

Non-controlling interests 1.5 1.9 - -

Capital employed 194.4 215.2 293.1 280.8

The financial statements were approved by the Board of Directors on 20 November 2018 and signed on its behalf by:

Steve Brown Sue Day Chris Kelly Andy Cosslett

Chief Executive Officer Chief Financial Officer President Chairman of the Board of Directors

Annual

Report

2018