Page 80 - RFU Annual Report 2018

P. 80

7 FINANCIAL STATEMENTS

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

8

27. Defined benefit pension scheme continued

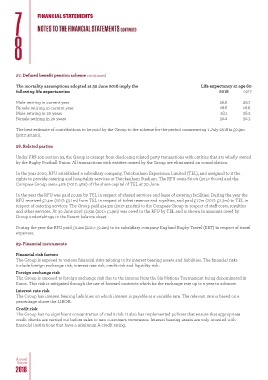

The mortality assumptions adopted at 30 June 2018 imply the Life expectancy at age 60

following life expectancies: 2018 2017

Male retiring in current year 26.6 26.7

Female retiring in current year 28.6 28.6

Male retiring in 20 years 28.1 28.3

Female retiring in 20 years 30.2 30.3

The best estimate of contributions to be paid by the Group to the scheme for the period commencing 1 July 2018 is £0.9m

(2017:

£0.5m).

28. Related parties

Under FRS 102 section 33, the Group is exempt from disclosing related party transactions with entities that are wholly owned

by the Rugby Football Union. All transactions with entities owned by the Group are eliminated on consolidation.

In the year 2000, RFU established a subsidiary company, Twickenham Experience Limited (TEL), and assigned to it the

rights to provide catering and hospitality services at Twickenham Stadium. The RFU owns 60.0% (2017: 60.0%) and the

Compass Group owns 40% (2017: 40%) of the share capital of TEL at 30 June.

In the year the RFU was paid £0.5m by TEL in respect of shared services and lease of catering facilities. During the year the

RFU received £2.4m (2017: £3.1m) from TEL in respect of ticket revenue and royalties, and paid £1.7m (2017: £2.3m) to TEL in

respect of catering services. The Group paid £14.3m (2017: £12.8m) to the Compass Group in respect of staff costs, royalties

and other services. At 30 June 2018 £2.5m (2017: £1.9m) was owed to the RFU by TEL and is shown in amounts owed by

Group undertakings in the Parent balance sheet.

During the year the RFU paid £0.2m (2017: £0.2m) to its subsidiary company England Rugby Travel (ERT) in respect of travel

expenses.

29. Financial instruments

Financial risk factors

The Group is exposed to various financial risks relating to its interest bearing assets and liabilities. The financial risks

include foreign exchange risk, interest rate risk, credit risk and liquidity risk.

Foreign exchange risk

The Group is exposed to foreign exchange risk due to the income from the Six Nations Tournament being denominated in

Euros. This risk is mitigated through the use of forward contracts which fix the exchange rate up to a year in advance.

Interest rate risk

The Group has interest bearing liabilities on which interest is payable at a variable rate. The relevant rate is based on a

percentage above the LIBOR.

Credit risk

The Group has no significant concentration of credit risk. It also has implemented policies that ensure that appropriate

credit checks are carried out before sales to new customers commence. Interest bearing assets are only invested with

financial institutions that have a minimum A credit rating.

Annual

Report

2018