Page 74 - RFU Annual Report 2018

P. 74

7 FINANCIAL STATEMENTS

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

2

Freehold

investment

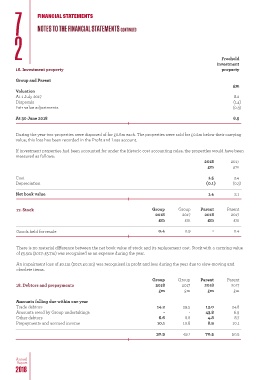

16. Investment property property

Group and Parent

£m

Valuation

At 1 July 2017 8.2

Disposals (1.4)

Fair value adjustments (0.3)

At 30 June 2018 6.5

During the year two properties were disposed of for £0.6m each. The properties were sold for £0.2m below their carrying

value; this loss has been recorded in the Profit and Loss account.

If investment properties had been accounted for under the historic cost accounting rules, the properties would have been

measured as follows:

2018 2017

£m £m

Cost 1.5 2.4

Depreciation (0.1) (0.3)

Net book value 1.4 2.1

17. Stock Group Group Parent Parent

2018 2017 2018 2017

£m £m £m £m

Goods held for resale 0.4 0.9 - 0.4

There is no material difference between the net book value of stock and its replacement cost. Stock with a carrying value

of £5.5m (2017: £5.7m) was recognised as an expense during the year.

An impairment loss of £0.1m (2017: £0.1m) was recognised in profit and loss during the year due to slow-moving and

obsolete items.

Group Group Parent Parent

18. Debtors and prepayments 2018 2017 2018 2017

£m £m £m £m

Amounts falling due within one year

Trade debtors 14.2 29.5 13.0 24.8

Amounts owed by Group undertakings - - 43.8 6.9

Other debtors 6.6 8.8 4.8 8.7

Prepayments and accrued income 10.1 10.8 8.9 10.1

30.9 49.1 70.5 50.5

Annual

Report

2018