Page 69 - RFU Annual Report 2018

P. 69

6

FINANCIAL STATEMENTS

7

Group Group Parent Parent

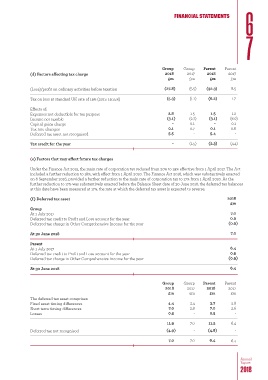

(d) Factors affecting tax charge 2018 2017 2018 2017

£m £m £m £m

(Loss)/profit on ordinary activities before taxation (27.8) (5.5) (32.3) 8.5

Tax on loss at standard UK rate of 19% (2017: 19.75%) (5.3) (1.1) (6.2) 1.7

Effects of:

Expenses not deductible for tax purpose 2.8 1.5 1.5 1.2

Income not taxable (3.1) (2.7) (3.1) (8.0)

Capital gains charge - 0.1 - 0.1

Tax rate changes 0.1 0.7 0.1 0.6

Deferred tax asset not recognised 5.5 - 5.4 -

Tax credit for the year - (1.5) (2.3) (4.4)

(e) Factors that may affect future tax charges

Under the Finance Act 2015, the main rate of corporation tax reduced from 20% to 19% effective from 1 April 2017. The Act

included a further reduction to 18%, with effect from 1 April 2020. The Finance Act 2016, which was substantively enacted

on 6 September 2016, provided a further reduction to the main rate of corporation tax to 17% from 1 April 2020. As the

further reduction to 17% was substantively enacted before the Balance Sheet date of 30 June 2018, the deferred tax balances

at this date have been measured at 17%, the rate at which the deferred tax asset is expected to reverse.

(f) Deferred tax asset 2018

£m

Group

At 1 July 2017 7.0

Deferred tax credit to Profit and Loss account for the year 0.9

Deferred tax charge in Other Comprehensive Income for the year (0.9)

At 30 June 2018 7.0

Parent

At 1 July 2017 6.4

Deferred tax credit to Profit and Loss account for the year 0.9

Deferred tax charge in Other Comprehensive Income for the year (0.9)

At 30 June 2018 6.4

Group Group Parent Parent

2018 2017 2018 2017

£m £m £m £m

The deferred tax asset comprises:

Fixed asset timing differences 4.4 3.4 3.7 2.8

Short term timing differences 7.0 3.6 7.0 3.6

Losses 0.5 - 0.5 -

11.9 7.0 11.2 6.4

Deferred tax not recognised (4.9) - (4.8) -

7.0 7.0 6.4 6.4

Annual

Report

2018