Page 68 - RFU Annual Report 2018

P. 68

6 FINANCIAL STATEMENTS

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

6

Group Group Parent Parent

2018 2017 2018 2017

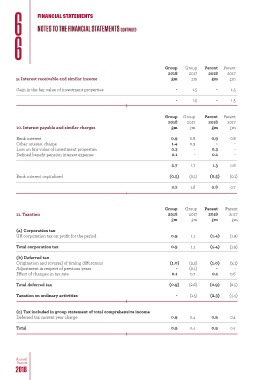

9. Interest receivable and similar income £m £m £m £m

Gain in the fair value of investment properties - 1.5 - 1.5

- 1.5 - 1.5

Group Group Parent Parent

2018 2017 2018 2017

10. Interest payable and similar charges £m £m £m £m

Bank interest 0.9 0.8 0.9 0.8

Other interest charge 1.4 0.9 - -

Loss on fair value of investment properties 0.3 - 0.3 -

Defined benefit pension interest expense 0.1 - 0.1 -

2.7 1.7 1.3 0.8

Bank interest capitalised (0.5) (0.1) (0.5) (0.1)

2.2 1.6 0.8 0.7

Group Group Parent Parent

11. Taxation 2018 2017 2018 2017

£m £m £m £m

(a) Corporation tax

UK corporation tax on profit for the period 0.9 1.1 (1.4) (1.9)

Total corporation tax 0.9 1.1 (1.4) (1.9)

(b) Deferred tax

Origination and reversal of timing differences (1.0) (3.2) (1.0) (3.1)

Adjustment in respect of previous years - (0.1) - -

Effect of changes in tax rate 0.1 0.7 0.1 0.6

Total deferred tax (0.9) (2.6) (0.9) (2.5)

Taxation on ordinary activities - (1.5) (2.3) (4.4)

(c) Tax included in group statement of total comprehensive income

Deferred tax current year charge 0.9 0.4 0.9 0.4

Total 0.9 0.4 0.9 0.4

Annual

Report

2018